Everything about What Is Trade Credit Insurance

Wiki Article

9 Easy Facts About What Is Trade Credit Insurance Described

Table of ContentsAll About What Is Trade Credit InsuranceThe Of What Is Trade Credit InsuranceSome Ideas on What Is Trade Credit Insurance You Need To KnowUnknown Facts About What Is Trade Credit InsuranceSome Ideas on What Is Trade Credit Insurance You Need To Know

Trade credit score insurance (TCI) compensates firms when their customers are unable to pay as a result of bankruptcy or destabilizing political conditions. Insurance providers commonly value their policies based upon the size and also variety of consumers covered under the policy, their creditworthiness, as well as the risk fundamental to the industry in which they run.Below are 3 various other feasible strategies. One alternative is to self-insure, which implies the organization develops its very own book fund particularly developed to cover losses from unsettled accounts. The downside to this strategy is that a firm might need to allot a substantial quantity of capital for loss prevention rather than using that cash to expand the organization.

An aspect typically acquires the right to those receivables at a considerable discountusually 70% to 90% of the invoiced amount. The lender may obtain a larger percent if the factor manages to collect the complete financial obligation, yet it still needs to pay a significant charge for the variable's services.

Basically, it's a guarantee from the acquiring company's financial institution that the seller will certainly be paid in full by a details day. Among the drawbacks is that these can just be obtained as well as spent for by the buyer, which may be unwilling to pay the transaction cost amount for the bank's assurance.

The smart Trick of What Is Trade Credit Insurance That Nobody is Discussing

That stands for a compounded annual development rate of 8. 6%.

Boost in sales as well as profits A credit history insurance coverage can usually offset its very own expense lots of times over, also if the policyholder never ever makes a claim, by increasing a business's sales as well as profits without additional danger. Boosted loan provider connection Profession credit scores insurance can improve a firm's connection with their lending institution.

With profession credit scores insurance, you can accurately manage the industrial as well as political dangers of profession that are beyond your control. Trade credit rating insurance policy can aid you feel safe and secure in extending much more credit score to present consumers or going after brand-new, bigger consumers that would certainly have otherwise appeared as well high-risk. look at this website There are 4 sorts of trade credit history insurance, as defined listed below.

Excitement About What Is Trade Credit Insurance

Whole Turnover This sort of profession credit insurance policy shields versus non-payment of industrial financial obligation from all clients. You can pick if this insurance coverage puts on all residential sales, international sales or both. Key Accounts With this kind of insurance policy, you select to insure your biggest consumers whose non-payment would certainly posture the best danger to your service.Transactional This type of trade credit report insurance policy shields against non-payment on a transaction-by-transaction basis as well as is best for business with few sales or only one consumer. Exceptional debts are not my review here covered unless there is straight trade in between your business as well as a consumer (one more business).

It is usually not the most efficient remedy, because rather than spending excess capital into growth chances, a company has to place it on hold in case of uncollectable loan. A letter of credit score is an additional choice, however it just offers financial obligation security for one consumer and also only covers worldwide profession.

The aspect provides a money breakthrough ranging from 70% to 90% of the billing's worth. When the invoice is gathered, the element returns the equilibrium of the invoice minus their fee. These expenses might range from 1% to 10%, based upon a range of elements. Some factoring solutions will certainly presume the risk of non-payment of the billings they buy, while others do not.

All About What Is Trade Credit Insurance

While receivables factoring can be helpful in the short-term, you will certainly have to pay costs varying from 1% to 5% for the service, even if the receivable is paid in full within 60-90 days. The longer the receivable continues next page to be unpaid, the greater the costs. Payment guarantees aren't constantly offered, and also if they are, they can increase factoring fees to as high as 10%.The financial institution or variable will offer the financing and the credit scores insurance coverage will safeguard the invoices. In this instance, when a funded billing goes unsettled, the case payment will most likely to the funder.

Credit report insurance coverage protects your cash circulation. Trade credit report insurance functions by insuring you versus your buyer falling short to pay, so every billing with that customer is covered for the insurance year.

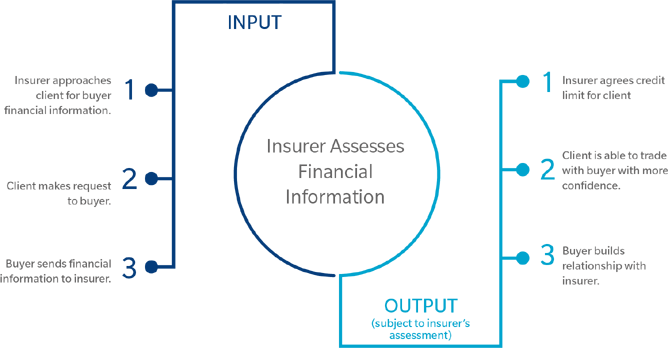

Most insurance policy options will consequently be customized to your needs. At Atradius Australia, we run a Modula Credit score Insurance Coverage. This permits us to customize the policy to your requirements. Atradius Credit Insurance policy described: Your credit score insurance company should check the monetary health of your customers and possible customers as well as use a threat ranking, often called a customer rating.

Everything about What Is Trade Credit Insurance

It will guide just how much of your exposure they are prepared to insure. The buyer ranking is additionally a helpful tool for you. You can use it as an overview to sustain your own due persistance and assist you prevent potentially risky clients. A strong purchaser score can likewise aid you safeguard prospective buyers by providing them good credit terms.

Report this wiki page